iedge s reit

Come towards the end of November CSOP iEdge S-REIT Leaders Index ETF will start trading on the Singapore Exchange SGX. Get detailed information on iEdge S-REIT Index REITSI including stock quotes financial news historical charts company background company fundamentals company financials insider trades annual reports and historical prices in the Company Factsheet.

Csop Iedge S Reit Leaders Index Etf Poems

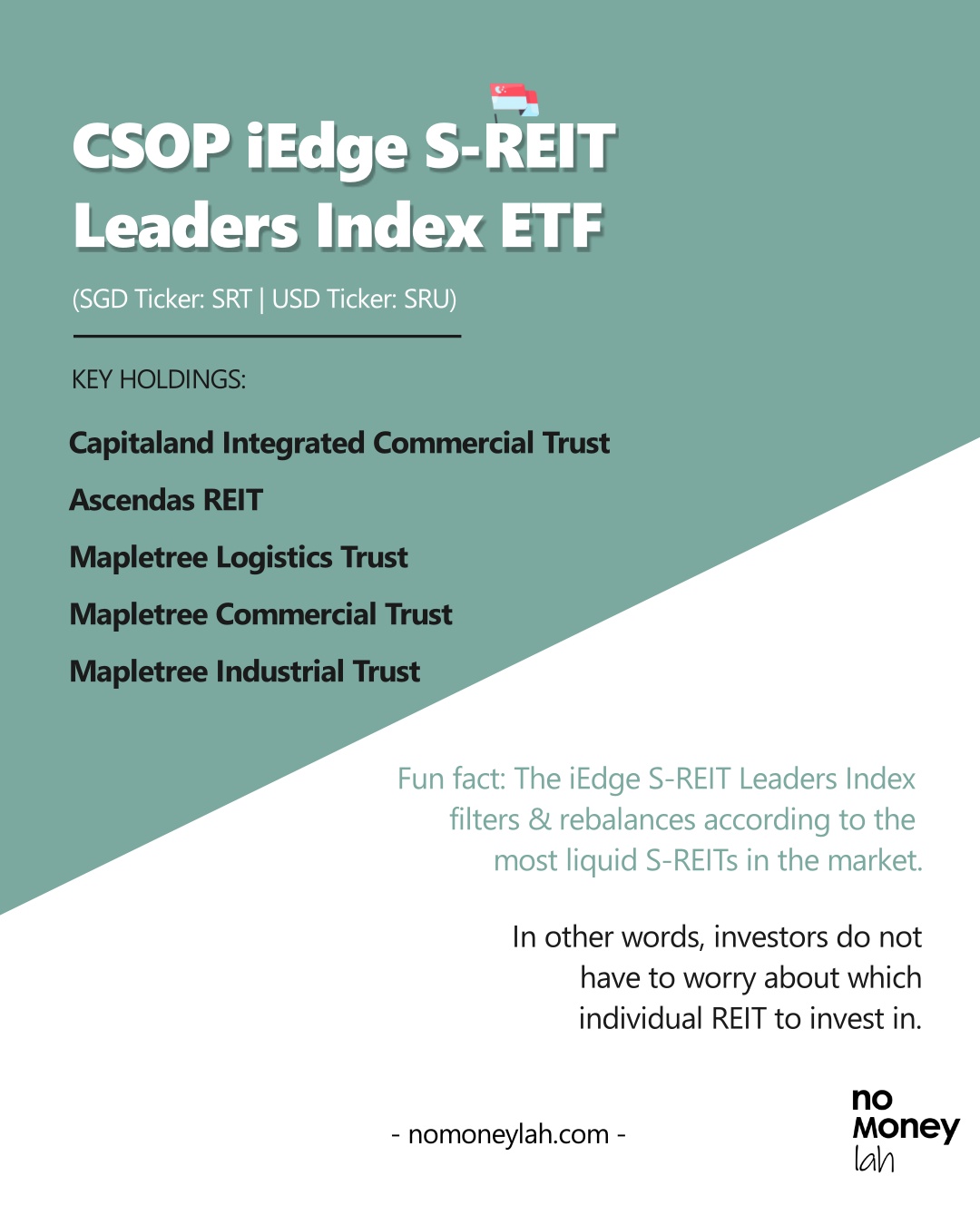

The CSOP iEdge S-REIT Leaders Index ETF is a sub-fund of the CSOP SG ETF Series I a Singapore unit trust.

. Your REIT with Risk Management portfolio will always have a REIT allocation of at least 50. Partners and drive the satisfaction of residents and tenants every day. Breaking News Jun 24 2022.

Before you think about investing in the CSOP iEdge S-REIT Leaders Index ETF here are 4 things about the ETF that you should first know. The REIT with Risk Management portfolio combines Singapore REIT with Singapore Government Bonds via the ABF Singapore Bond Index Fund. The ETF invests in a diversified basket of REITs listed on the SGX while aiming to replicate the performance of the SGX iEdge S-REIT Leaders Index a tradable liquidity-adjusted free-float.

The fund tracks the performance of the iEdge S-REIT Leaders Index which mostly comprises S-REITs. The REIT component in this portfolio also tracks the SGXs iEdge S-REIT Leaders index. The CSOP iEdge S-REIT Leaders Index ETF has a management fee of 05 and a total expense ratio of 06 which is capped and would be deducted annually as fees.

The iEdge S-Reit Index dipped 13 per cent in total returns in Q2 2022 while the sector as a whole saw S173 million of net institutional outflows and S282 million of net retail inflows. 7 rows Launched in 2014 the iEdge S-REIT Leaders Index is an index established to measure the. We strive to improve our work generate long-term value for our investors and.

CICT is in top position because of its office exposure. TWO Expected Total Return. 22 Rexford Industrial Realty REXR 5793 is a fast-growing industrial warehouse REITREXR could be one of the best REITS for the remainder of 2022.

Theres going to be a new kid on the REIT ETF block giving investors another option to invest in Singapore REITs seamlessly. SGX as of 30 June 2021 6 Source. Proxied by iEdge S-REIT Leaders SGD Index Total Return 4 Source.

Singapore REITs A Reopening Story. Growth Track is SGX Groups podcast series where we focus on investment and growth opportunities across Asia. It saw S2 million of net institutional inflows and S10 million of net retail inflows.

The iEdge S-Reit Index held resilient for the first half of 2022 generating flat total returns compared to the FTSE EPRA Nareit Developed Index a benchmark for global Reits which declined 18 per centDuring the period the S-Reits and property trusts sector in Singapore saw S359 million of net institutional outflows and S447 million of net retail inflowsHospitality. The CSOP iEdge S-REIT Leaders Index ETF is a diversified and liquid instrument that offers investors a cost effective way to easily access the Singapore REITs market. Stocks jump to close out second best week of 2022.

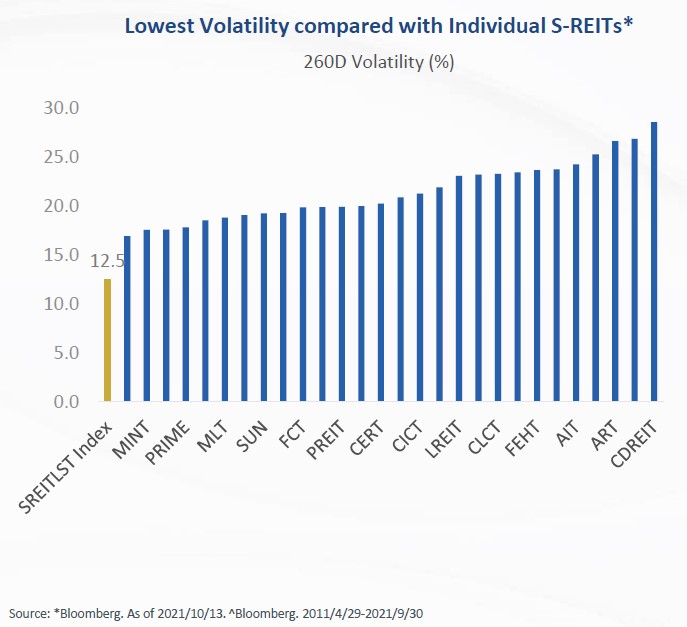

Heres the interesting thing compared to other REIT indices the index that CSOP follows iEdge Leaders S-REIT Index has a slightly. The iEdge S-REIT Leaders Index isnt new in fact it has been around since 2014. Top REIT 7.

View live IEDGE S-REIT INDEX chart to track latest price changes. Lets find out more about this new exchange-traded fund ETF that tracks a real estate investment trust REIT. CSOP iEdge S-REIT Leaders Index ETF was launched in Nov 2021 to track the iEdge Leaders S-REIT Index top holdings are Singapores biggest industrial and office REITs.

Is a residential mortgage real estate investment trust mREIT. We invest acquire manage and develop assets. Get CSOP iEdge S-REIT Leaders Index ETF CSOP-SGSingapore Exchange real-time stock quotes news price and financial information from CNBC.

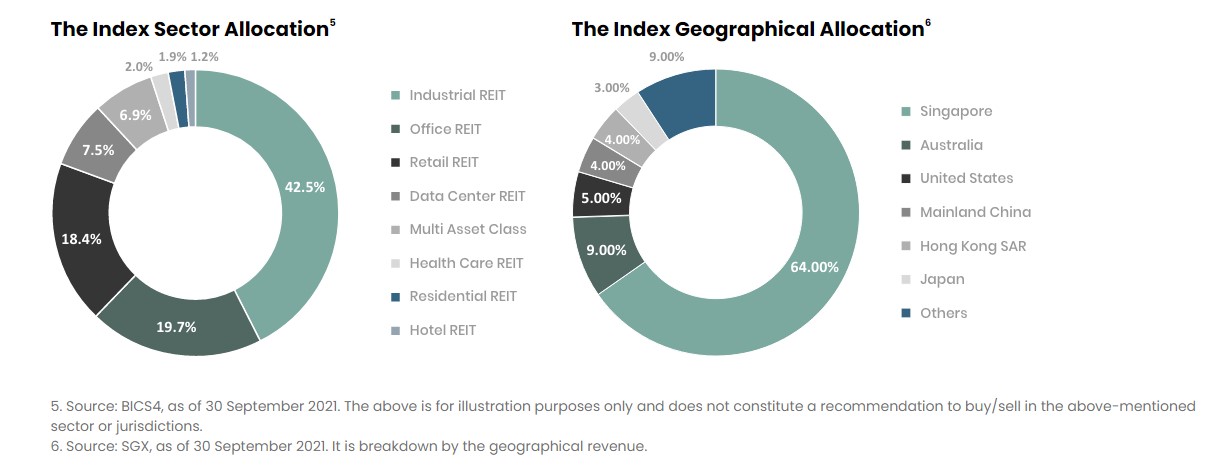

SGX as of 30 September 2021 5 Source. The funds manager applies an indexing-investment strategy or passive management to track its performance. Two Harbors Investment Corp.

Securities Fixed Income Derivatives Indices Data Connectivity Sustainable Finance Regulation. A real estate investment trust in Singapore S-REIT is a fund on SGX that invests in a portfolio of income generating real estate assets such as. As part of a diverse portfolio.

SGXREIT trade ideas forecasts and market news are at your disposal as well. The iEdge S-Reit Index dipped 13 per cent in total returns in Q2 2022 while the sector as a whole saw S173 million of net institutional outflows and S282 million of net retail inflows. ESR-Logos Reit was the only S-Reit which received both net institutional and retail inflows for Q1 2022.

ESR-Logos Reit was the only S-Reit which received both net institutional and retail inflows for Q1 2022. As such it focuse s on residential mortgage backed securities RMBS residential mortgage loans mortgage servicing rights and commercial real. The CSOP iEdge S-REIT Leaders Index ETF is available in two main currencies SGD and USD.

Find the latest information on iEdge REIT REITSI including data charts related news and more from Yahoo Finance. The iEdge S-REIT Leaders Index is a narrow tradable adjusted free-float market capitalisation weighted index that measures the performance of the most liquid real estate investment trusts in Singapore in SGD. Bloomberg CSOP 6 May 2016.

Tune in to Growth Track Podcast. It is a market. Correspondingly the manager.

SP 500 adds 31 Dow gains 823 points or 27 on Friday. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income. IEdge S-REIT Leaders Index USD - Singapore Exchange SGX Loading.

Two Harbors Investment Corp. Our practice runs on rigor collaboration and commitment. Fundrise just delivered its 21st consecutive positive quarter.

It saw S2 million of net institutional inflows and S10 million of net retail inflows. Frasers Logistics Commercial Trust SGXBUOU 848 Weightage Previously known as Frasers Logistics Industrial Trust the enlarged REIT was formed as a result of a merger with Frasers Commercial Trust on 29 April 2020 and renamed as Frasers Logistics Commercial Trust with effect from 04 May 2020. 99 billion Dividend yield.

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Csop Iedge S Reits Leaders Etf Stock Code Srt Sru Hardwarezone Forums

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

Csop Iedge S Reit Leaders Index Etf What Investors Should Know About This New Reit Etf

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Does Inflation And Rising Interest Rate Affect Reits Featuring Csop Iedge S Reit Leaders Index Etf Edition

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

S Reit Report Card Here S How Singapore Reits Performed In Fy2018

Csop Iedge S Reit Leaders Index Etf To List On Sgx

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Constituents Of The Iedge S Reit Index Companies Markets The Business Times

Singapore Reit Etfs Guide Comprehensive

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Csop Iedge S Reits Leaders Index Etf Riding The Wave With S Reits Leaders Youtube

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Reits Report Card 2022 How Singapore Reits Performed In 1st Quarter 2022

Csop Iedge S Reit Leaders Index Etf What Investors Should Know About This New Reit Etf

0 Response to "iedge s reit"

Post a Comment